June 12, 2012

Delays Imperil Mining Riches Afghans Need After Pullout

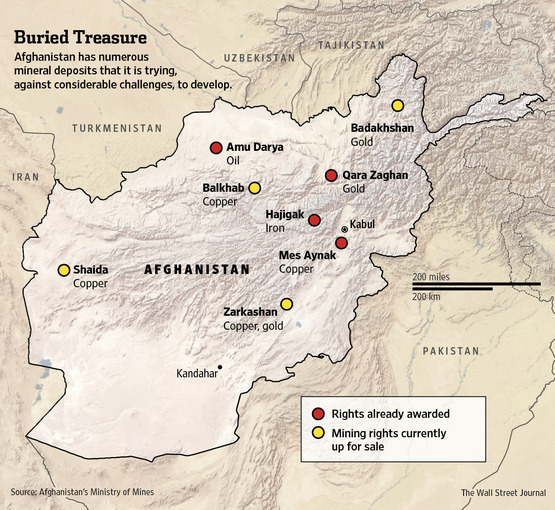

By DION NISSENBAUM MES AYNAK, Afghanistan--Mullah Mira Jan, a tribal elder in the dry hills south of Kabul, was an early supporter of Afghanistan's push to develop its mining industry and bring new wealth to one of the world's poorest countries. He and his extended family accepted $10,000 in 2009 to move and make way for a sprawling copper mine here. Three years later, the family still lives in a mud-walled temporary home without running water or regular electricity, within sight of a fenced-off hilltop where the government promised villagers they could build a new community. "The people imprisoned in Guantanamo Bay have more facilities than we do," Mr. Jan said one morning inside his crumbling home. His feeling of betrayal runs so deep that he is urging other villagers to reject government attempts to move them, a defiant stand that could imperil a project at the center of Afghanistan's effort to tap its mineral riches. That underground wealth, as much as $1 trillion by some estimates, offers one of Afghanistan's best hopes for standing on its own financially when the U.S.-led military coalition withdraws most troops and much of its aid by the end of 2014. Besides the copper deposit at Mes Aynak, which a Chinese consortium has pledged to invest $3.5 billion to develop, Afghanistan has awarded rights to extract iron ore, gold and oil, to companies from India, Canada, the U.S. and Britain. The Mes Aynak project offers a warning of how difficult it is likely to be for Afghanistan to cash in on its mineral wealth. Delays in the now five-year-old project threaten to deprive a fragile Afghan state of a crucial revenue stream when it will be most needed, in the first years after the U.S. and its allies withdraw most of their military forces. International experts have warned the government that neglecting to provide new communities to relocated villagers like Mr. Jan could not only jeopardize the Mes Aynak mine but undercut projects elsewhere and possibly provoke violent opposition, fueling the insurgency that is already strong in the area. "This mine is not going to thrive if these communities fail," said Michael Stanley, the lead mining specialist at the World Bank. "The No. 1 risk is the social license to operate." Insurgent attacks are already a threat. Afghan officials said last month they had thwarted a likely attack on the Chinese project when an informant told them of a stash of artillery shells and launchers hidden near the site. Afghan officials say they and the Chinese consortium have tried to address the concerns of villagers like Mr. Jan by giving some of them jobs with the mine project and crafting a detailed relocation plan. Mr. Jan, 51 years old, makes $300 a month working for the Afghan Ministry of Culture and representing archeologists working on the project. Part of the problem is that the villagers "had a lot of expectations that were not justified," says Afghanistan's mining minister, Wahidullah Shahrani. "Before Aynak, the kids had no access to education, no jobs. Now they have all these things." Mes Aynak contains $40 billion worth of untapped minerals, by some estimates. Afghanistan's finance minister, Omar Zakhilwal, says he expects the project to be generating at least $300 million in annual royalties for the government in Kabul by 2016. That would account for some 15% of its civilian budget. The project, however, has been plagued by delays and controversies from the start. Around the end of 2009, an Afghan mining official left his post shortly after an allegation surfaced in the U.S. press that he had accepted a bribe in connection with the awarding of the contract, an accusation that he and the alleged giver both denied. According to a 2010 cable from the U.S. embassy in Beijing released by WikiLeaks, the organization that releases previously private documents and cables online, a commercial attaché at Afghanistan's embassy in Beijing told U.S. diplomats that Afghan officials viewed the Chinese investors as "a cow to milk" for bribes. Transparency hasn't been a salient feature of the nascent Afghan mining industry. Details of the contract for the Mes Aynak project, among others, remain shrouded in secrecy. Early on, Afghan officials said the Chinese consortium developing it had pledged to build a railway network linking the area to neighboring countries such as Pakistan and Uzbekistan. That could be an economic boon to Afghanistan, which now has just 60 miles of railroads. An Afghan mining minister called the railway commitment a "nonnegotiable" part of the deal with the Chinese, according to a 2010 U.S. diplomatic cable released by WikiLeaks. But Afghan officials now say the Chinese aren't contractually obligated to build a railroad. They are expected to study the rail project but can shelve it if they conclude it isn't worth the investment, Mr. Shahrani, the mining minister, said in an interview. Other plans envisioned when the contract was let in 2007 also have yet to materialize, among them a 400-megawatt power plant and a coal mine. The Chinese consortium, which includes state-run China Metallurgical Group and Jianxi Copper Co., said it plans to spend two years assessing the railway project and is still conducting a study of its plans for a power plant and coal mine. So far, the site 25 miles southeast of Kabul consists of little more than bare scrubland plus a complex of two-story, blue-topped housing units for Chinese workers. This is guarded by 1,500 members of a special mine-protection force, paid by the Chinese. Besides them, the Chinese consortium employs about 300 other Afghans, out of a total of 3,000 Afghans it is expected eventually to hire for the project in addition to the guards. One cause of the delays was the discovery of ancient Buddhist monasteries at Mes Aynak, long-buried by the shifting sands. These have required a salvage effort, led by French archeologists, that remains ongoing. Also still under way is an effort to clear the area of land mines laid during the Soviet occupation of Afghanistan in the 1980s. The Chinese companies don't have to pay the Afghan government any significant royalties until they actually start mining, said an adviser working on the project.

Besides potentially straining the government's finances after the U.S. pullout, the delays could directly affect the security situation in the local province, Logar, one where the Taliban are active. "If we get to 2014 and they haven't put a shovel in the ground, you are going to see it become a bigger point of contention because someone got moved out of their home for nothing," said one of the international advisers working on the project. Some of the advisers privately wonder whether the Chinese companies might be looking to delay their work until they can see how stable Afghanistan is once most Western troops head home over the next two years. "The security situation in Afghan is indeed worrisome," the group said in a written response to questions. "The security conditions of the project have been improved…. We believe the government and people have the capability and wisdom to well manage the security problems in and after year 2014." The Chinese companies say they are still assessing what it will take to make the site profitable. China Metallurgical, also known as MCC, said it is impossible to say when it will start mining. Afghan officials are alarmed by the prospect of more delay. "We are applying pressure" on the consortium, said Mr. Zakhilwal, the finance minister. "We don't want the companies to come and sit on our resources and wait it out." The biggest mineral extraction contracts so far have gone to state-run companies from China and a government-led consortium from India, which last fall won rights to develop the largest iron-ore deposit. Companies from the U.S., which has spent tens of billions of dollars and suffered thousands of military casualties in Afghanistan over the past decade, have by and large remained spectators. The biggest U.S. mining involvement is in a consortium of Western companies, organized by a unit of J.P. Morgan Chase & Co., that is investing $50 million to develop a northern Afghanistan gold mine. Some American companies have complained that the bidding process was tilted toward government-controlled companies. The argument is that Afghanistan's emphasis on receiving the highest possible royalties, rather than on other issues such as the environment, favors state-owned companies that may have less need than purely commercial ones to worry about profits. "It's been difficult to get U.S. firms and Western firms interested in Afghanistan," said Alexander Benard, managing director of Gryphon Partners, a Washington-based firm run by his father, Zalmay Khalilzad, a former U.S. ambassador to Afghanistan. "There are huge issues around political stability, huge issues around infrastructure and major question marks about what's going to happen in Afghanistan as the United States continues to draw down." Mr. Benard lashed out at the contracting process last fall after Western companies represented by his firm lost to Chinese state-run companies for drilling rights to an oil field in the north called Amu Darya that is said to hold 87 million barrels. A Pentagon-backed review board has since examined the Amu Darya tender and concluded the process was fair. Just as with the Mes Aynak copper project, exactly what the oil-drilling contract provides remains clouded in secrecy. Despite government pledges to disclose details of agreements, only one major contract has been released to the public so far. A recent report by Global Witness, an independent advocacy group that focuses on natural resource exploitation, said there was a "major gap" between the government's promises of transparency and its follow-through. As for the villagers who were moved out of their houses at Mes Aynak and still don't have a new community, Mr. Shahrani, the mining minister, says that because of education and jobs they are better off now than before they moved. Villagers stuck for three years in temporary mud-wall compounds don't see it this way. "We were told everything would be fine, but here we are," said Mr. Jan's 90-year-old father, Gulzar, as he leaned on a cane outside the crumbling family home with a "Welcome" sign in English on the wooden door. "We've been betrayed by our government." --Kersten Zhang, Junting Yolanda Zhang and Habib Khan Totakhil contributed to this article.

Write to Dion Nissenbaum at dion.nissenbaum@wsj.com