http://www.nytimes.com/2011/06/20/business/20tax.html

June 19, 2011

Companies Push for Tax Break on Foreign Cash

By DAVID KOCIENIEWSKI

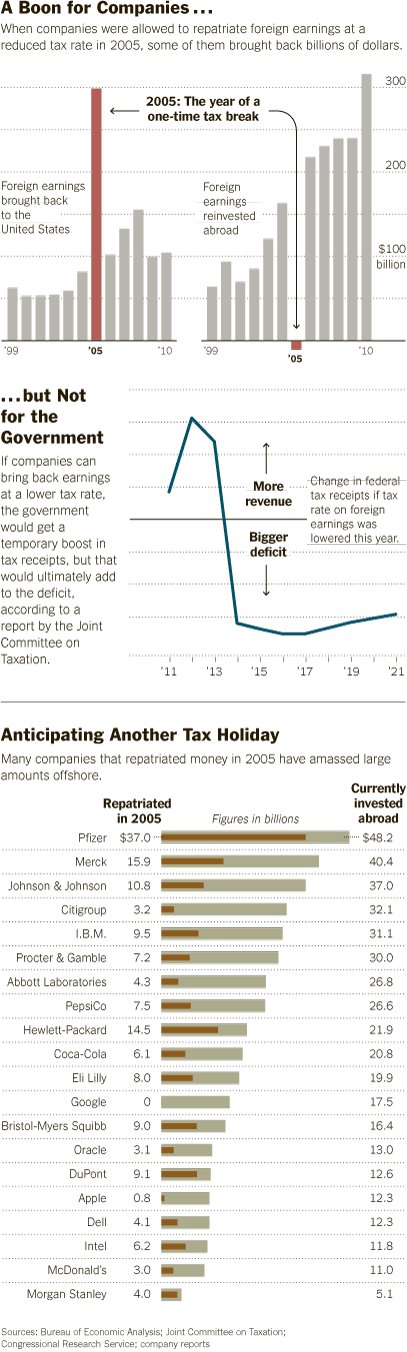

Some of the nation's largest corporations have amassed vast profits outside the country and are pressing Congress and the Obama administration for a tax break to bring the money home.

Apple has $12 billion waiting offshore, Google has $17 billion and Microsoft, $29 billion.

Under the proposal, known as a repatriation holiday, the federal income tax owed on such profits returned to the United States would fall to 5.25 percent for one year, from 35 percent. In the short term, the measure could generate tens of billions in tax revenues as companies transfer money that would otherwise remain abroad, and it could help ease the huge budget deficit.

Corporations and their lobbyists say the tax break could resuscitate the gasping recovery by inducing multinational corporations to inject $1 trillion or more into the economy, and they promoted the proposal as "the next stimulus" at a conference last Wednesday in Washington.

"For every billion dollars that we invest, that creates 15,000 to 20,000 jobs either directly or indirectly," Jim Rogers, the chief of Duke Energy, said at the conference. Duke has $1.3 billion in profits overseas.

But that's not how it worked last time. Congress and the Bush administration offered companies a similar tax incentive, in 2005, in hopes of spurring domestic hiring and investment, and 800 took advantage.

Though the tax break lured them into bringing $312 billion back to the United States, 92 percent of that money was returned to shareholders in the form of dividends and stock buybacks, according to a study by the nonpartisan National Bureau of Economic Research. [1]

This money comes from overseas operations and in some cases accounting maneuvers that shift domestic profits to low-tax countries. The study concluded that the program "did not increase domestic investment, employment or research and development."

Indeed, 60 percent of the benefits went to just 15 of the largest United States multinational companies -- many of which laid off domestic workers, closed plants and shifted even more of their profits and resources abroad in hopes of cashing in on the next repatriation holiday.

Merck, the pharmaceutical giant based in Whitehouse Station, N.J., was one of those big winners. The company brought home $15.9 billion, second overall to Pfizer's $37 billion. It used the money for "U.S.-based research and development spending, capital investments in U.S. plants, and salaries and wages for the U.S.," a Merck spokesman, Steven Campanini, said last week.

According to regulatory filings, though, the company cut its work force and capital spending in this country in the three years that followed.

Merck used the cash infusion to continue paying dividends and buying back stock for the benefit of shareholders and executives -- even as it was rocked by more than $8 billion in costs to settle a variety of disputes after executive missteps. Merck had to pay billions in back taxes to the I.R.S.; billions more to consumers suing because of the dangerous side effects of the painkiller Vioxx, and hundreds of millions to the Justice Department, which had accused the company of defrauding Medicare.

The tax break, part of the American Jobs Creation Act, lacked safeguards to ensure the companies used the money for investment and job creation in the United States, as Congress intended. "There were no direct tracing requirements," said Jay B. Schwartz, head of Merck's international tax unit until 2006. "So once the money came home, it gave you great flexibility."

Finding Work-Arounds

Although the law forbade the use of repatriated funds directly for executive compensation or stock buybacks, companies found plenty of ways around it. "Fungibility is one of my favorite words," Mr. Schwartz said.

As Congress was debating the tax cut in 2004, senior executives at Merck anxiously followed the battle through Congress. Some company officials were worried that the costs of the Vioxx lawsuits might top $10 billion and push the company to the brink of bankruptcy, Mr. Schwartz said. When the measure was finally signed into law by President George W. Bush in October 2004, "there was a lot of excitement, a lot of cheering," among senior management, he said. Merck executives declined to comment.

Merck brought back $15.9 billion in October 2005. The next month, it unveiled a restructuring plan to cut 7,000 jobs. Over the next three years, about half those cuts were made in the United States, where the company's employment fell to 28,800 jobs, from 31,500.

How big the job cuts would have been without the tax break is unknown, though Mr. Schwartz said contingency plans called for painful reductions throughout the company.

That restructuring was harsh in places like Albany, Ga., one of the nation's poorest communities, where Merck closed its Flint River manufacturing plant and shed more than 400 workers.

"It was like going through a sudden divorce," said Connie McKissack, now 45, who had worked at the company for a dozen years as a systems analyst.

While it is impossible to pinpoint where its repatriated dollars went, Merck devoted much more money in the next few years to closing plants and dismissing workers. For the three years that ended in 2008, those outlays jumped to $455 million annually, from $107 million in 2004. (Merck officials declined to respond to detailed questions about how the repatriated money figured into its cash flow.)

Meanwhile, the company accelerated payments on its debt, kept its dividend steady and continued to buy back more than a billion dollars a year in its own stock -- cushioning the blow of immense legal costs to its shareholders and executives.

Drug companies benefited greatly from the tax break, but many companies in other industries did, too. Ford, Pepsi and Honeywell took advantage. Like Merck and Pfizer, Hewlett-Packard repatriated money, $14.5 billion, and soon after it announced it was eliminating jobs, 14,000.

The WIN America coalition, a multimillion-dollar campaign underwritten by dozens of global businesses, counters that many companies like Cisco Systems, Adobe and Qualcomm used some of the repatriated money to hire thousands of workers.

The group says another tax holiday would bring even more jobs now. Doug Thornell, an adviser to WIN America, cites a 2008 study commissioned by the corporations suggesting that it could spur 450,000 new jobs.

"This is about creating jobs, expanding U.S. businesses and strengthening American companies," said Representative Kevin Brady, a Republican from Texas, who has introduced such a bill.

Yet the author of the corporate study, Allen L. Sinai, has since cooled on the idea. His research was conducted during the financial crisis in late 2008. Then, corporations could not easily raise capital, Mr. Sinai, an economist at Decision Economics, explained in an interview last month. They were reluctant to hire workers or spend in other ways.

Rethinking the Plan

Today, credit is readily available. In fact, many of those pushing hardest for the break are sitting on billions in cash in the United States that they could use to hire if they chose.

The break would make sense, Mr. Sinai now says, only if Congress carefully restricted the proceeds to increases in domestic hiring and investment.

"Many who want this policy try to advocate it as a jobs-creation program, but that is not what I found," he said. "What I found was that it would shore up the corporate balance sheets during the depths of the financial crisis and create some jobs. But the balance sheets are already so good that I don't think there's a rationale any longer that simply rebuilding the companies' finances will lead to hiring."

Supporters of the measure had also promoted the tax law as good for investment in plants and research. An academic study, published in the National Tax Journal last December, said companies reported investing as much as $75 billion of the money in equipment and facilities.

For Merck, it was nearly a wash. In the three years beginning with the repatriation, the company increased its spending on research and development domestically by several billion dollars, according to regulatory filings. But its capital spending actually declined in that time.

Much the same happened elsewhere, according to a review of taxpayer data by the National Bureau of Economic Research. "For every dollar that was brought back, there were zero cents used for additional capital expenditures, research and development, or hiring and employees wages," said Kristin J. Forbes, a professor of economics at the Massachusetts Institute of Technology's Sloan School of Management who was a member of President Bush's council of economic advisers and who led the study.

A Short-Lived Boost

The break did provide the Treasury with a quick shot in the arm. When Merck brought its $15.9 billion back, it paid $731 million to the I.R.S. All told, companies brought back $312 billion in 2005 and paid $16 billion in taxes.

The numbers would presumably be much bigger now. Technology companies, in particular, have been holding more profits abroad. Companies based in the United States have increased their holdings offshore to more than $1.5 trillion, meaning the tax break could generate $50 billion in tax revenue the first year.

The budget aid could be short-lived, however. Because companies would be encouraged to bring back profits in one year, tax revenues would be smaller in future years. Furthermore, companies might park future profits offshore in hopes of another holiday. The Joint Committee on Taxation, the nonpartisan Congressional office, estimated the program's cost at $79 billion in lost revenues over 10 years.

Supporters of the proposal say that estimate is too high and predict that the repatriation holiday would pay for itself by encouraging hiring and other economic activity. Others say it is a reasonable price for economic aid from the private sector.

The Obama administration has been uncharacteristically harsh in its criticism of the idea. President Obama and Treasury Secretary Timothy F. Geithner have said they will support it only if it is part of a corporate tax overhaul that results in no decline in federal revenues.

The prospect of profitable corporations getting a break as social programs are being cut has aroused tax protesters and labor organizations like the Service Employees International Union, which say it would reward companies for moving jobs and investment overseas.

US Uncut, a group that protests corporate tax avoidance, has criticized Apple for seeking tax breaks even as it racks up enormous growth and profits. The group has held dance-ins at Apple stores, demonstrated outside a company conference and released a video spoofing an iPod commercial, declaring "I love my iPod, but iHate the tax cheat."

But the break could still be part of a budget compromise. With the economy languishing, unemployment high and Congressional Republicans opposed to additional stimulus, the idea has gained some unlikely allies, including some Democrats, the organization Third Way and the onetime union leader Andy Stern.

"Even if it costs the government $80 billion in the long haul, it would be worth it to try to put people to work now," said Mr. Stern, the former president of the S.E.I.U., who suggests dedicating the tax revenue to an infrastructure bank that would support public works projects. "Having it overseas doesn't help. And we have to do something."