13 October 2018, NYT: Jared Kushner Paid No Federal Income Tax for Years, Documents Suggest

https://www.nytimes.com/2018/10/13/business/kushner-paying-taxes.html

Oct. 13, 2018

How Jared Kushner Avoided Paying Taxes

President Trump's son-in-law and senior adviser appears to have paid almost no federal income taxes for several years running.

By Jesse Drucker and Emily Flitter

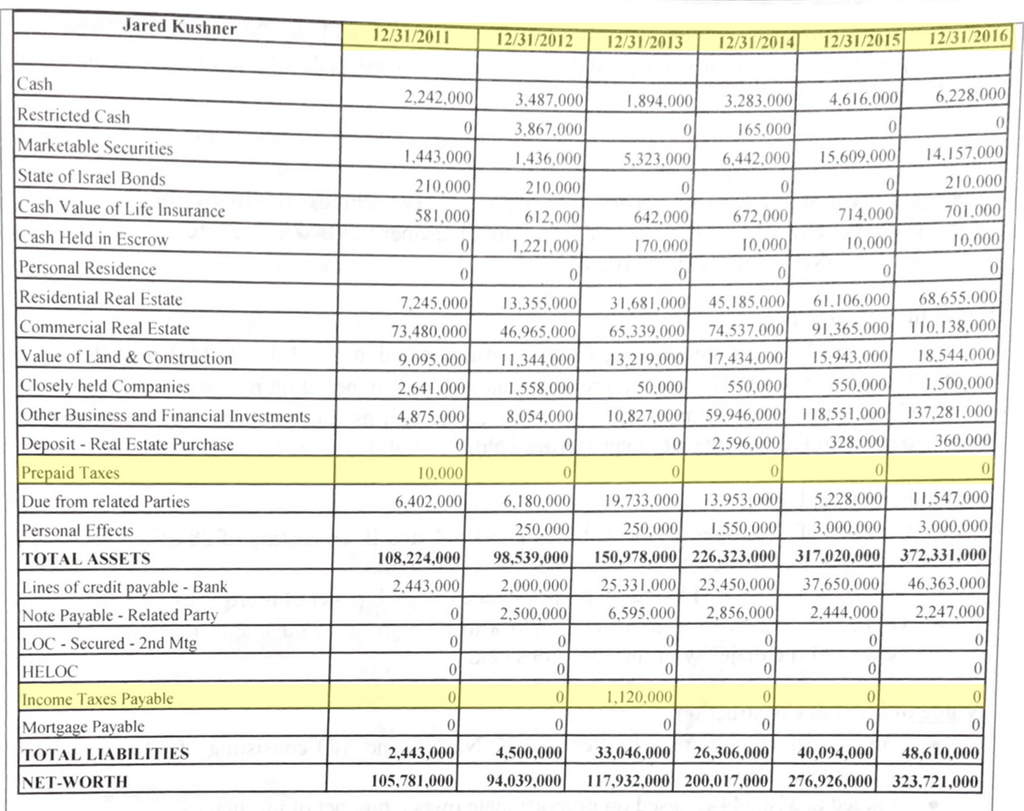

Jared Kushner has a net worth of almost $324 million, and his company has been profitable. But Mr. Kushner, who is President Trump's son-in-law and senior adviser, appears to have paid almost no federal income taxes for several years running, according to documents reviewed by The New York Times.

Here's an example of how he did it:

Step 1: The Purchase

Kushner Companies buys a property. The majority of the money for the purchase comes in the form of mortgages and personal loans from banks.

Step 2: The Write-Off

Under the federal tax code, real estate investors can write off the purchase price of the building -- excluding the cost of the land -- over a period of decades. Although Kushner Companies has spent little or no cash of its own, the firm takes large annual deductions based on the theoretical depreciation of the building.

Step 3: The Loss

The property generates cash for the Kushners. But any earnings, which would be subject to the federal income tax, are swamped by the amount that the company is taking in write-offs for depreciation. The result is that Kushner Companies records a net loss for tax purposes.

Step 4: The Investors

The company passes on that loss to its owners, including Mr. Kushner and his father, Charles.

Step 5: The Offset

The loss can be used to offset the Kushners' income in the year it is recorded, and it can be carried forward to cancel out future income or to get refunds for taxes they paid in previous years.

Step 6: The Deferral

When Kushner Companies sells a property, it can use the proceeds to finance a new acquisition. If done within the right time frame, the company can indefinitely defer any capital-gains taxes it might owe on the sale of the original property.

Step 7: The Result

The outcome is apparent in Jared Kushner's tax returns, which were summarized in the documents reviewed by The New York Times. Here's an example from 2015.

Income

* W-2 income: $198,000.

* Taxable interest: $536,000.

* Dividends: $1,000.

* Capital gains: $974,000.

Deductions

* Tax losses from real estate and other partnerships: $3.5 million.

* Tax losses carried forward from previous years: $4.8 million.

Total adjusted gross income

* Negative $6.6 million.

Tax refund

* $4,000.

Peter Mirijanian, a spokesman for Mr. Kushner's lawyer, Abbe Lowell, said he would not respond to assumptions derived from documents that provide an incomplete picture and were "obtained in violation of the law and standard business confidentiality agreements."

"However," he continued, "always following the advice of numerous attorneys and accountants, Mr. Kushner properly filed and paid all taxes due under the law and regulations."

The Documents

The documents that The Times reviewed were created, with Mr. Kushner's cooperation, as part of a review of his finances by an institution that was considering lending him money. Totaling more than 40 pages, they describe his business dealings, earnings, expenses and borrowing from 2009 to 2016. They contain information that was taken from Mr. Kushner's federal tax filings, as well as other data provided by his advisers. The documents, mostly created last year, were shared with The Times by a person who has had financial dealings with Mr. Kushner and his family.

The documents include Mr. Kushner's net worth statement, shown below.

Highlights added by The Times.

Highlights added by The Times.